FormsByAir for AML Reporting Entities

"Anti Money Laundering" and "Countering Financing of Terrorism" legislation is used in many countries to detect and deter money laundering and terrorism financing.

Lawyers became "reporting entities" as part of New Zealand's AML/CFT legislation on 1 July 2018, with Accountants following on 1 October 2018, and Real Estate Agents on 1 January 2019.

Compliance involves a range of activities as described by the FMA here. We're happy to refer you to a specialist for help with risk assessment, and in developing a compliance programme.

A major part of compliance is the requirement to verify the identity of your clients. Rather than subjecting them to a separate process, we provide a seamless onboarding experience that includes identity verification.

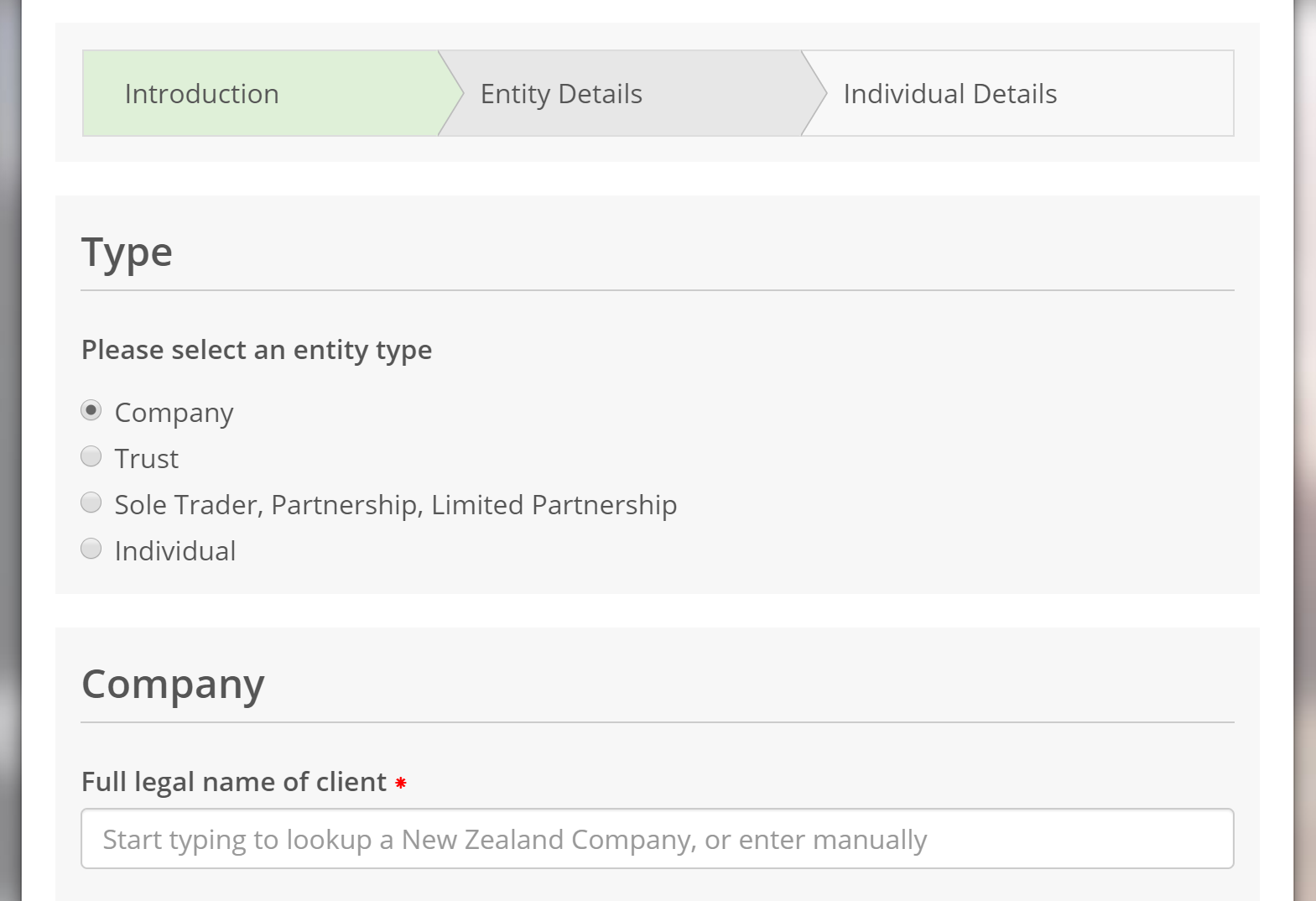

New clients can simply click through from your website to complete a branded online form. We then provide identity verification results for your records, and integrate client data directly with your CRM or practice management system.

In many cases, your client may be a trust or company. Identity verification must include all beneficial owners (real people). To make this easier, our forms pull shareholder and director details from the New Zealand Companies Office. Where beneficial owners are not physically located together, our system can send unique links to each person so they can independently complete their part of the form.

All of our forms are mobile responsive and work in a web browser, no app install required.

Try our sample customer due diligence form

Learn about how we work and then get in touch for pricing